Asshole to breakfast bro.

U wot m8?

Is that a saying I’m not familiar with?

Formerly /u/Zagorath on the alien site.

Asshole to breakfast bro.

U wot m8?

Is that a saying I’m not familiar with?

“commonly”?

Also “associated with religion/church”? I didn’t know that about Adelaide and I’m Australian.

Where in America is regarded the “mid Atlantic coast”? Because this description implies that it’s around New York, but as a non-American, NY looks very northern. I’d have said mid Atlantic is like…North Carolina and Virginia.

Cheese and ravioli is probably the worst one here. It should be quaver, two semiquavers, and then either two more quavers, or a semiquaver and a dotted quaver.

The tater tots one is also half the speed it should be, assuming the same tempo as the others. Should be two semiquavers and a quaver, repeated twice, instead of two quavers and a crotchet.

We’re missing E, F, F#, G, Ab, to be more precise.

Fuck me that’s stupid.

Australian politicians from our main two parties very obviously think like this as well. But they’re both—even the right-wing “hates the poor” party—smart enough to not fucking say it out loud. They even pay lip service to the idea housing should be “affordable” from time to time.

Evil is just a judgment call made by humans about the intentional and uncoerced actions of other humans

Cancer is not an intentional and uncoerced action of other humans.

Earthquakes and tsunamis are not intentional and uncoerced actions of other humans.

If an omnipotent and omnibenevolent god existed, there would be no justification for these.

Just eyeballing it the organisms looks maybe 2/3rds the size of rivers?

Yup. See my top-level comment.

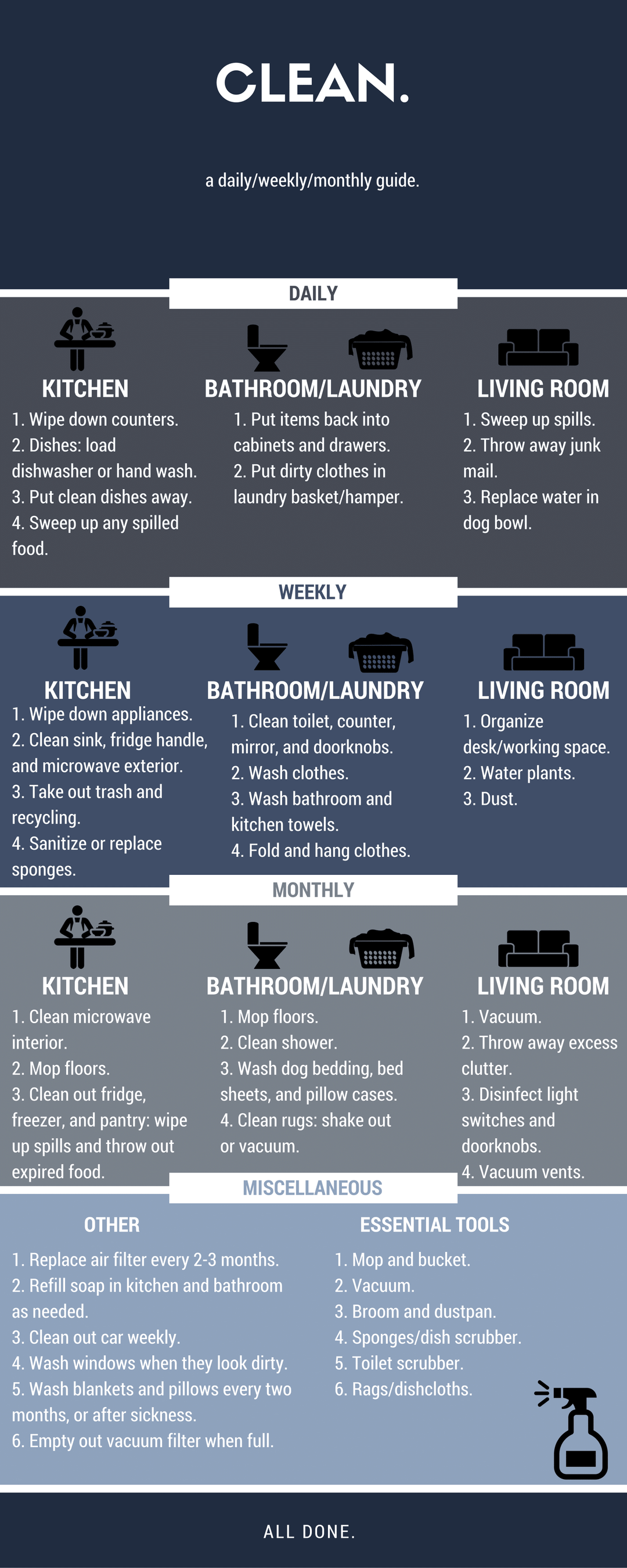

I actually don’t think it’s a very good guide.

It’s laid out by room, but at least for me that’s not how tasks work. I don’t think “yes, I must vacuum the lounge now” or “today I must mop the bathroom”. Instead it’s more like “now I’m going to mop the house” or “time to vacuum”. Because the hardest part of any of these chores is the initial hurdle of getting started, but once you’ve started it’s just logical to do the whole house.

Plus, the guide would be enhanced by a place where tasks can be physically checked off, so this person can see for themselves very clearly which tasks have and have not been done in the allotted timeframe. (They would have to have a specific day of the month/week where they always rub out the ticks.)

Image seems to have been deleted. Here’s a re-upload.

Interesting. How does that interact with your take-home paycheque? In Australia your income tax is deducted by your employer, so if your only interaction with the tax system is “do job. make money. pay tax on that money”, come tax time you should get 0 tax bill and 0 refund, it already having been paid as you go.

If it’s a tax credit outside the income tax system, I imagine that would be taken into account after the fact? So you end up getting a big refund every year. Which is nice, but surely would be nicer to have had the money all year? Or do employers’ payroll systems take that into account basically like it’s part of income tax?

Arkansas is definitely not forgettable, if only because it’s just Ar+Kansas with a ludicrous pronunciation. It’d be a bit like getting Virginia but not West Virginia.

Rhode Island isn’t forgettable for me at least, partly just because “it’s got island in its name but mostly isn’t an island” is a fun bit of trivia, and also because of pop culture things like Miss Congeniality, or that Providence judge who’s popular on YouTube.

Baltimore is a city that I recognise the name of, but couldn’t have told you what state it’s in without looking it up. It’s also not in that top tier of famous cities I would have banned if asked to name cities, like NYC, Vegas, and Austin. I might have gotten to it eventually, but that’s only a maybe.

Delaware I think you’re probably right. I probably wouldn’t remember it without the prompting of both the letters and the map. Just the map alone and it’d have no chance of getting it. I’d maybe get it from just the abbreviations. But as it was, I did get it, which is better than I did for Maryland. As for Delaware facts…it has an eponymous river, right? I definitely can’t give many facts about it.

No I understood what they meant. I just completely reject the notion that that is in any way fair.

I was trying to find the equivalent stats for my country. So far I have failed to do so, but I did find this page. And holy shit I didn’t realise it was so rare to have a 0 marginal income tax bracket. America being shitty is little surprise to me, but Canada, Spain, and Germany wow. And the UK and Sweden with their lowest marginal rate being as high as Australia’s median income’s marginal rate. That seems grossly unfair to the poorest people in the country.

Edit: I did later find this which at first seemed to be pretty much the thing I was initially looking for, but on closer inspection…the UK’s effective average tax rate is way less than half of their lowest marginal income tax, so it’s obviously not doing what it seems to be doing from the title.

I actually completely agree with your first paragraph about the definition of burden. I think anything which places a cost on you is fair to call a burden, even if it’s one that greatly benefits society or even yourself personally in the long run.

But your second paragraph is nonsense. There’s nothing fair about a flat tax. Flat taxes place a greater burden on the lowest income, because they tend to spend a higher percentage of their income and save less, simply due to necessities being a higher percentage of their income. A flat tax completely ignores this fact.

A fair society is one on which the more you earn, the more you give back. Because you can give back more without it causing you significant extra burden.

The first paragraph is important because of this way of defining what is fair. The fact that we can accept that tax is still a burden means we can explain what is a fair tax by trying to minimise the cumulative burden on taxpayers while maximising the amount of tax brought in.

I think I’m gonna name MD America’s official most forgettable state.

I’m not American so obviously there’s not particularly important reason for me to be able to name all 50 states, but with the aid of this chart I could get all the way to 48. I dunno if I placed them all correctly (who could possibly know if “ME” and “MA” refer to Massachusetts and Maine respectively, or inversely, and unlike MO, which devoid of the context of the full map I might’ve guessed was Montana, these two don’t have geography to help out, being right next to each other), but even with a map and the abbreviations, I can’t for the life of me figure out MD.

Or MN, while I’m at it. But for some reason that one feels like one I’ll be slightly more embarrassed to have forgotten if I looked it up.

Why have 4 of the studies seemingly not used error bars at all‽ Like I get that different analyses will arrive at different results, but they should always have error bars, right?

One of the terrible things about depression…that it makes it harder for you to do the very things that help reduce its effects like cook well, socialise, and exercise.